Finovate Europe 2025: Conference Review

I attended Finovate Europe 2025, a major fintech conference in London that brings together banks, startups, and investors to showcase what’s next in finance. It’s fast-paced — product demos, keynotes, and discussions on everything from AI to digital payments — all packed into two days.

It was my first professional conference in London, and I honestly had fun. It felt like walking into the centre of financial innovation — a mix of sharp suits, startup energy, and endless conversations about what’s changing next.

Why I Went

The two-day delegate pass cost around £1,100, which included breakfast, lunch, evening drinks, and full access to every attendee’s contact details through the event app.

That’s the standard rate, but there were discounts available for students, press, startups, and small businesses, which makes it a bit more accessible depending on your category.

For founders, product teams, or anyone selling something, that level of access is gold. For someone like me — still researching, learning, and exploring the landscape — it was more mixed value. I didn’t go to pitch anything; I went to see where the industry is heading, talk to builders, and understand how data, AI, and regulation are reshaping finance.

There were also book signings, plenty of freebies from companies, and demo sessions that made the event surprisingly engaging. Watching startups pitch live and seeing real products on stage made it feel less theoretical and more tangible. The tech demos were genuinely fun to watch — fast, competitive, and inspiring.

What I Learned

1. Banks Are Turning Data Into Infrastructure

From the Analyst All-Stars Panel, the message was clear:

European banks see compliance as the foundation of their digital strategy.

Asia’s fintech adoption continues to lead globally.

Real-time payments are now an expectation, not a feature.

Regulation is a catalyst — the smartest firms treat it as a strategic advantage.

Banks are quietly reorganising around data as infrastructure — not just as an output. That shift is changing everything from risk management to customer experience.

2. Agentic AI Is the Next Phase

AI came up in nearly every talk. What stood out wasn’t hype, but a practical playbook for adoption:

Start with low-risk, internal use cases.

Use proven models (OpenAI, Claude) before custom builds.

Make AI everyday-use, not an IT project.

Always go through compliance, never around it.

One session highlighted the #1 impactful use case across the industry:

Strategic foresight — co-piloting decisions with AI.

It’s a shift from analytics to autonomy — systems that think, assist, and learn. That idea stuck with me because it connects directly to what I’m trying to understand: intelligent risk models that feel more like assistants than dashboards.

3. Pure AI-Native Models Are Coming

The most interesting line I heard:

“What are the models we can’t imagine yet?”

Right now, most fintech startups are just adding AI on top of old processes. But the next generation will be AI-native — companies built entirely around autonomy, data, and real-time decision-making.

Just as Facebook wasn’t a better MySpace, it was a new category — the same will be true for fintech. The winners won’t just digitise banking; they’ll redefine it.

Tracey Fellows keynote address on AI.

Talks, Demos & The Atmosphere

The talks were genuinely inspiring — industry leaders shared honest insights about compliance, data, and innovation. Even as an outsider, I found it energising to hear from people who’ve built products that shape how billions transact every day.

The demos were the highlight: fast-paced, seven-minute pitches where startups showed real products live on stage. It was a great way to see what’s actually being built — no fluff, no theory. For anyone in fintech, it’s the perfect window into the competitive edge of the industry.

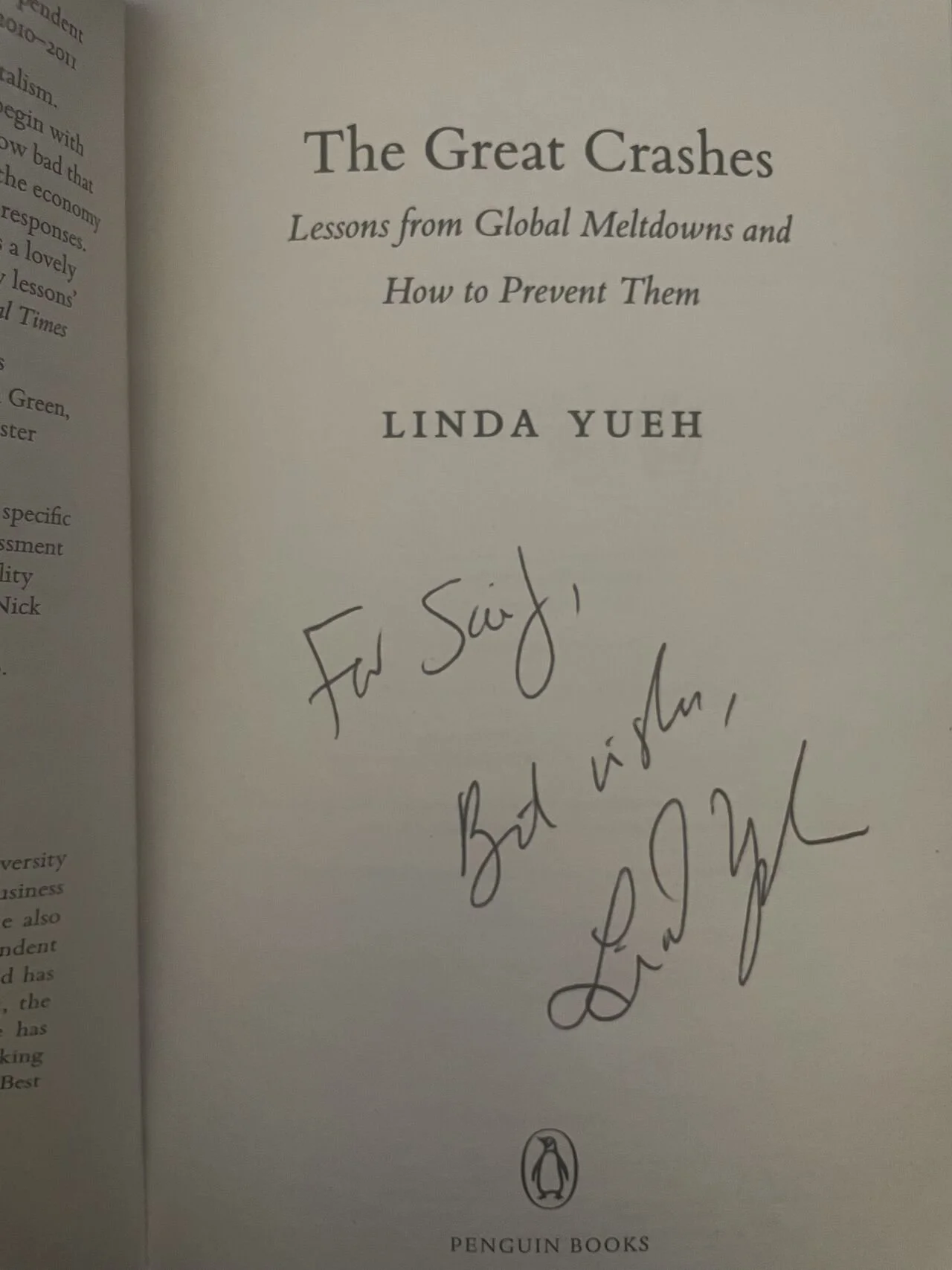

There were also free giveaways, company booths, and even book signings where you could meet authors and founders. Those little things made it feel like a celebration of fintech culture — not just another corporate event.

Signed after Linda Yueh’s keynote address on the escalation of geoplotical risk.

Personal Takeaways

I met a few brilliant builders and had some really valuable conversations about learning curves, building small, and failing forward.

Those chats made the event worthwhile. They also gave me the push to start vibe-coding at home — experimenting with small AI systems and automations to learn by doing.

Value for money?

For me: once, yes. Not again soon.

It was a valuable snapshot of where the industry is going, but unless you’re selling, fundraising, or deeply embedded in fintech, it’s not a repeat investment.

Exposure to new ideas⭐⭐⭐⭐

Networking quality⭐⭐⭐

Practical learning⭐⭐⭐⭐

ROI for inspiration⭐⭐⭐⭐⭐

If you work in banking or finance, or your company can sponsor your ticket, it’s worth every pound.

But if you’re more of an observer or a sponge, one visit is enough to see the landscape, absorb the energy, and walk away inspired.

Closing Reflection

Finovate reminded me that the real revolution in finance isn’t about new apps — it’s about agents: intelligent systems that learn, reason, and execute.

And sometimes, paying to watch that future unfold once is enough to motivate you to start building your own version of it.