The Lab

Experiments in quantifying the uninsurable.

I am currently building AION, an AI-native underwriting engine designed to bridge the gap between technical space data and insurance capital.

This feed documents the build in real-time: the technical bottlenecks, the architectural pivots, and the solutions required to deploy a working Risk Engine.

Active Module: M2 (Context & Explainability)

AION: Module 2 — From Black Box to Glass Box

The Problem: Calculators Aren't Enough

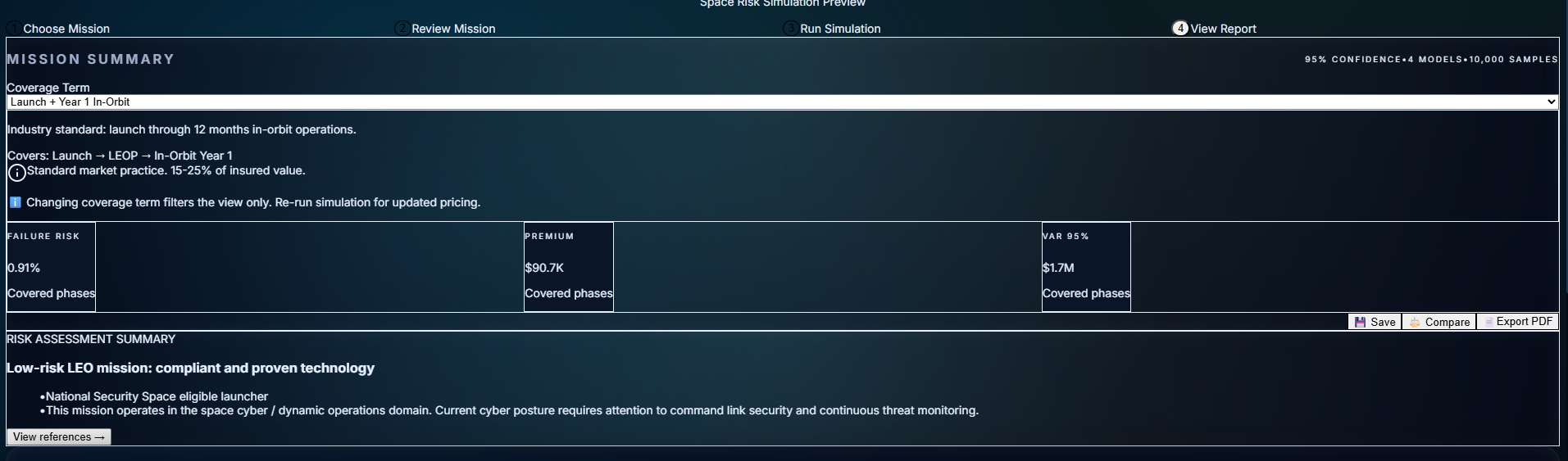

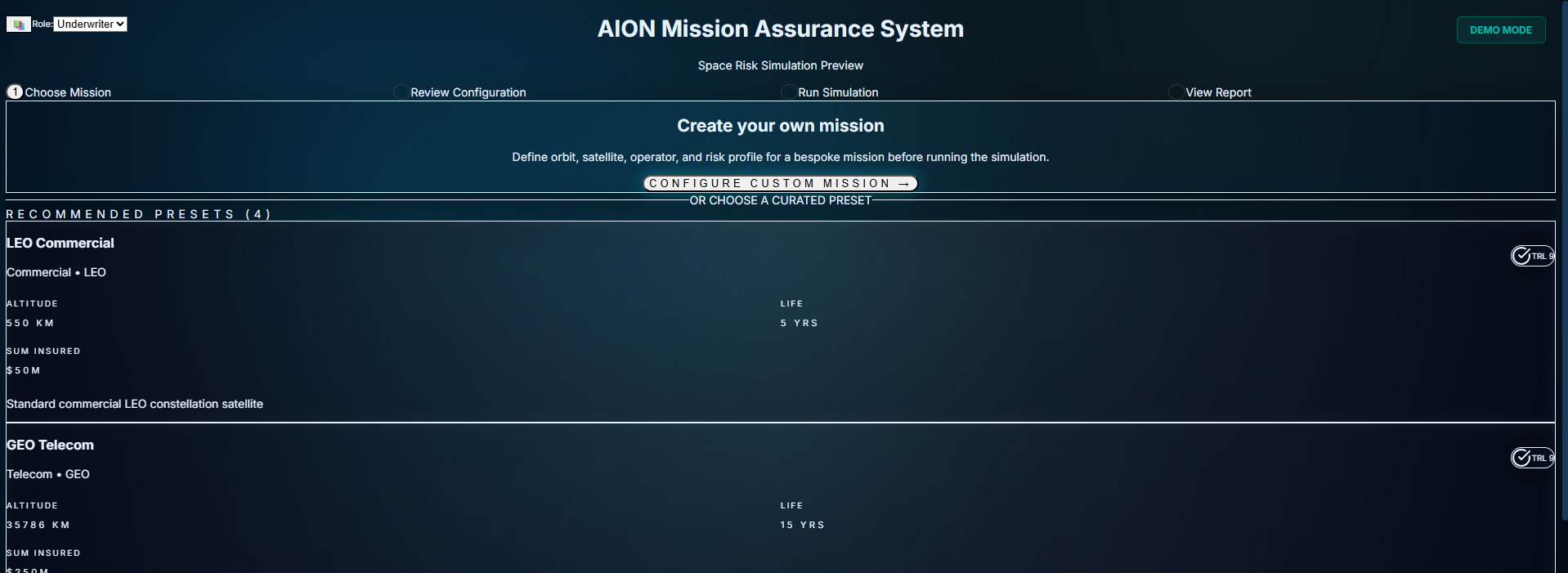

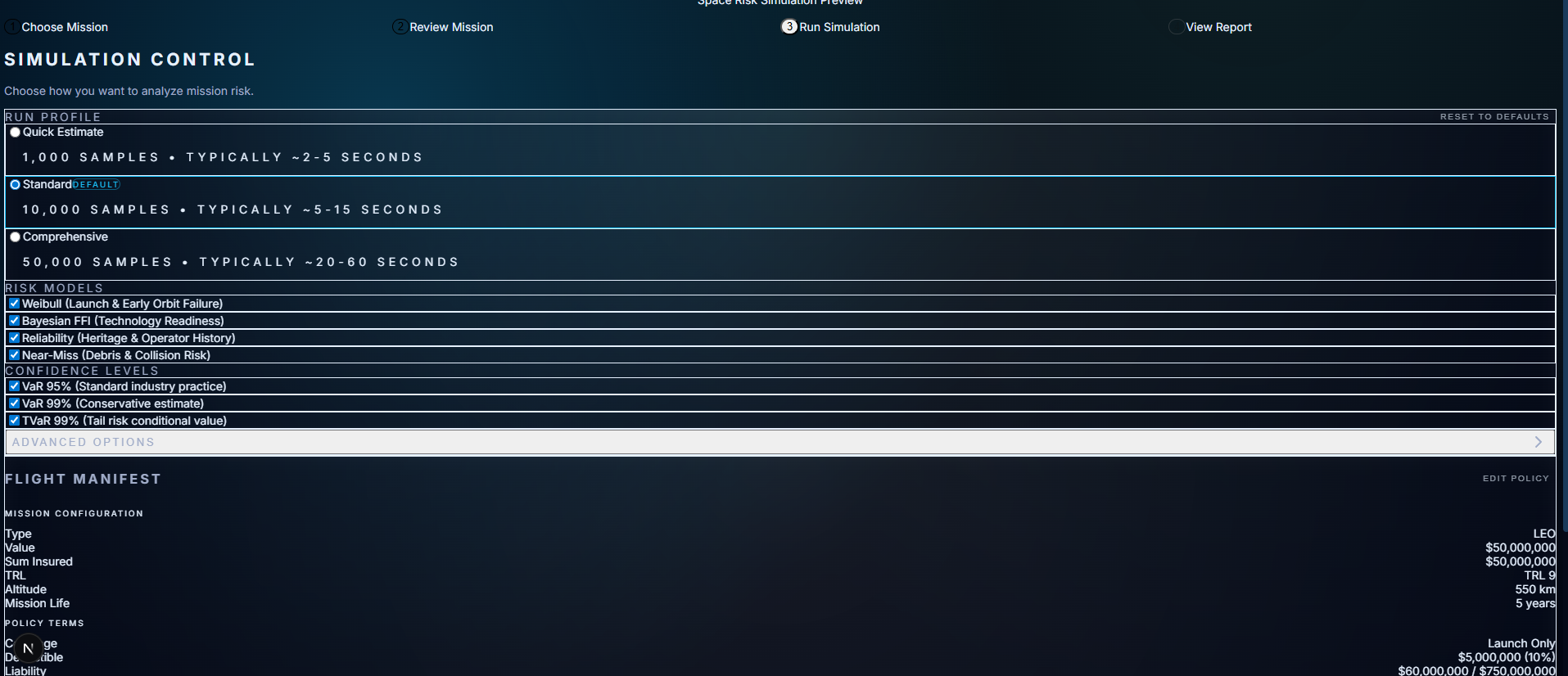

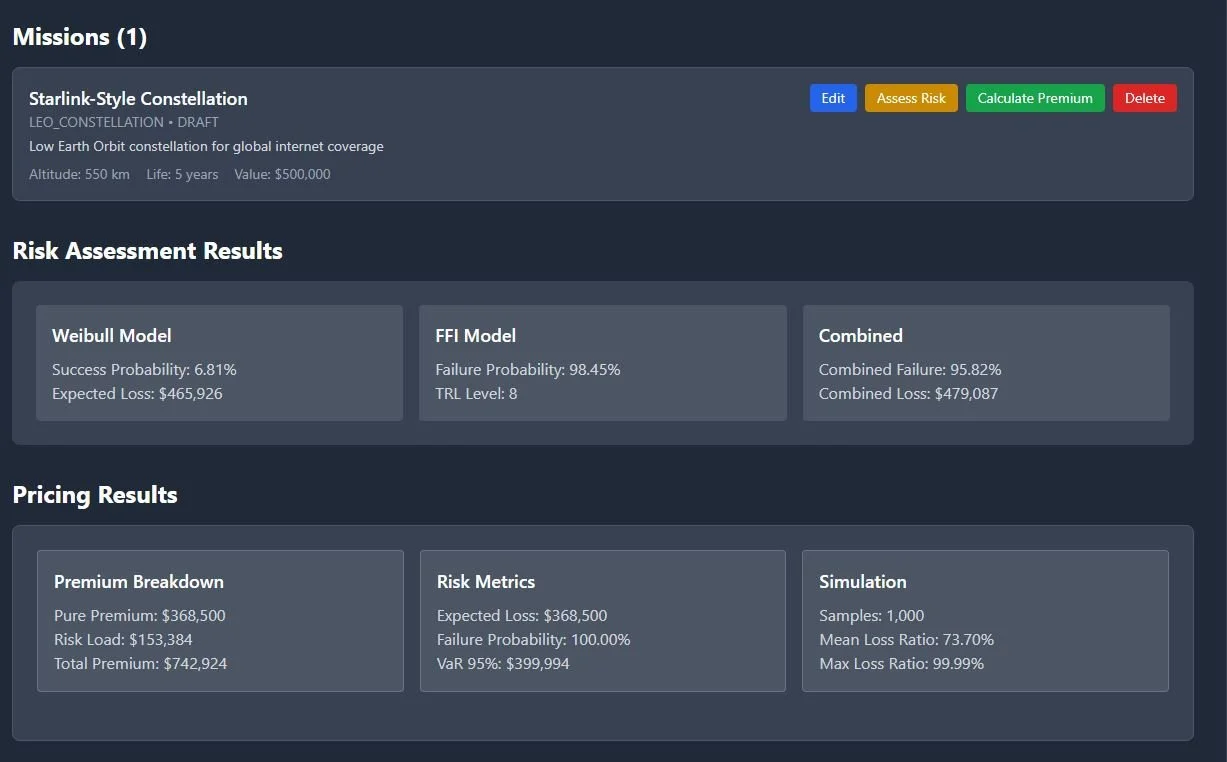

Module 1 gave you numbers. You could configure a mission, run the Monte Carlo model, and get a premium out the other side. It was fast. It was mathematically sound.

But in speciality insurance, numbers aren't enough.

A junior underwriter can run a model. A senior underwriter knows the model is only 10% of the story. They ask:

"Is this mission even legal under current UKSA regulations?"

"Have we seen a similar satellite configuration fail in LEO before?"

"Is this operator sanctioned?"

"Why is the premium 12.4%?"

If your system can't answer those questions—if it just says "trust me"—it's useless in the Lloyd's market. You need to defend every quote to capital providers, brokers, and regulators.

Module 1 turned AION into a risk brain.

Module 2 is the difference between a calculator and a senior underwriter.

It's the Context Engine: the piece that checks regulatory compliance, remembers past missions, explains every metric, and cites its sources. It turns AION from "here's a number" into "here's a defensible underwriting decision with regulatory backing and portfolio precedent."

Timeline: December 2–11, 2025 (9 days, ~180 hours) · Status: ✅ Frozen for V1

What I Built: The Context Engine

Module 2 delivers four core capabilities:

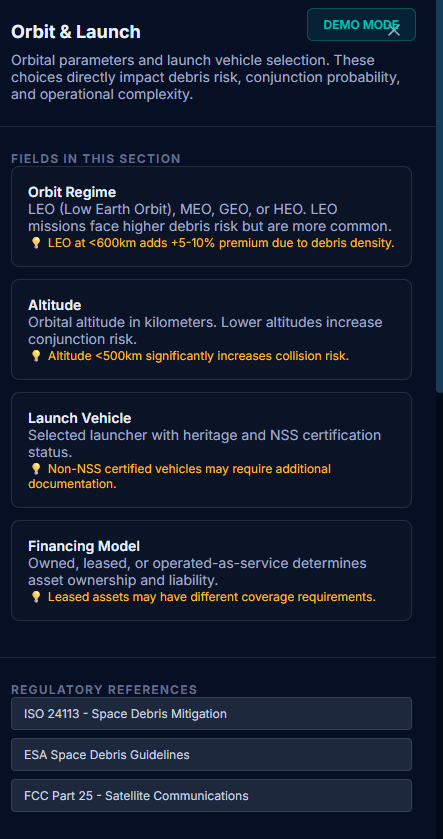

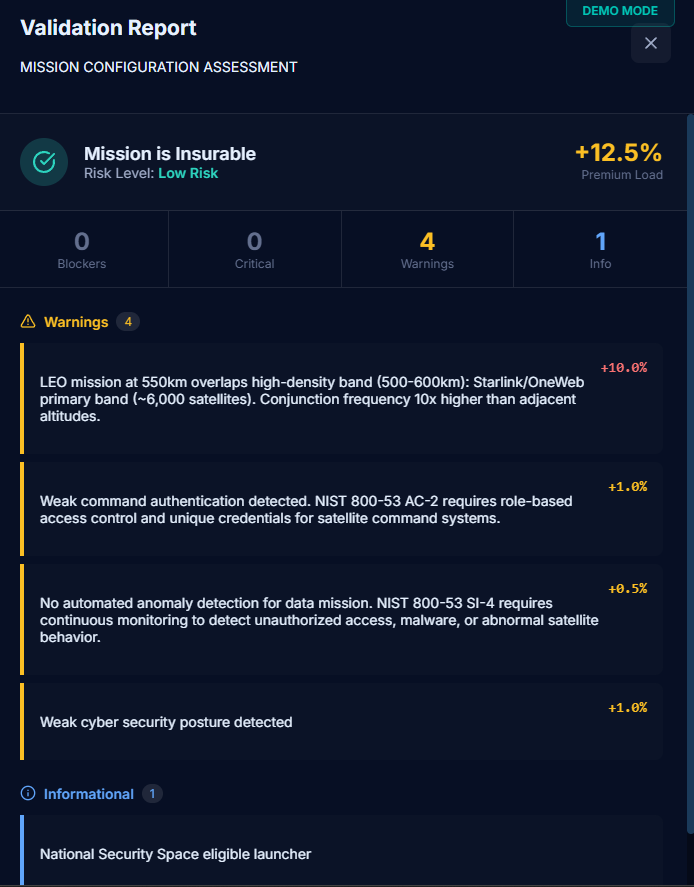

1. Regulatory Validation (22 Rules)

A rule engine that checks missions against international regulations, market access restrictions, technical safety requirements, and financial viability before pricing runs.

Traffic-light system (GREEN / AMBER / RED)

Each flag backed by citations to specific regulatory clauses

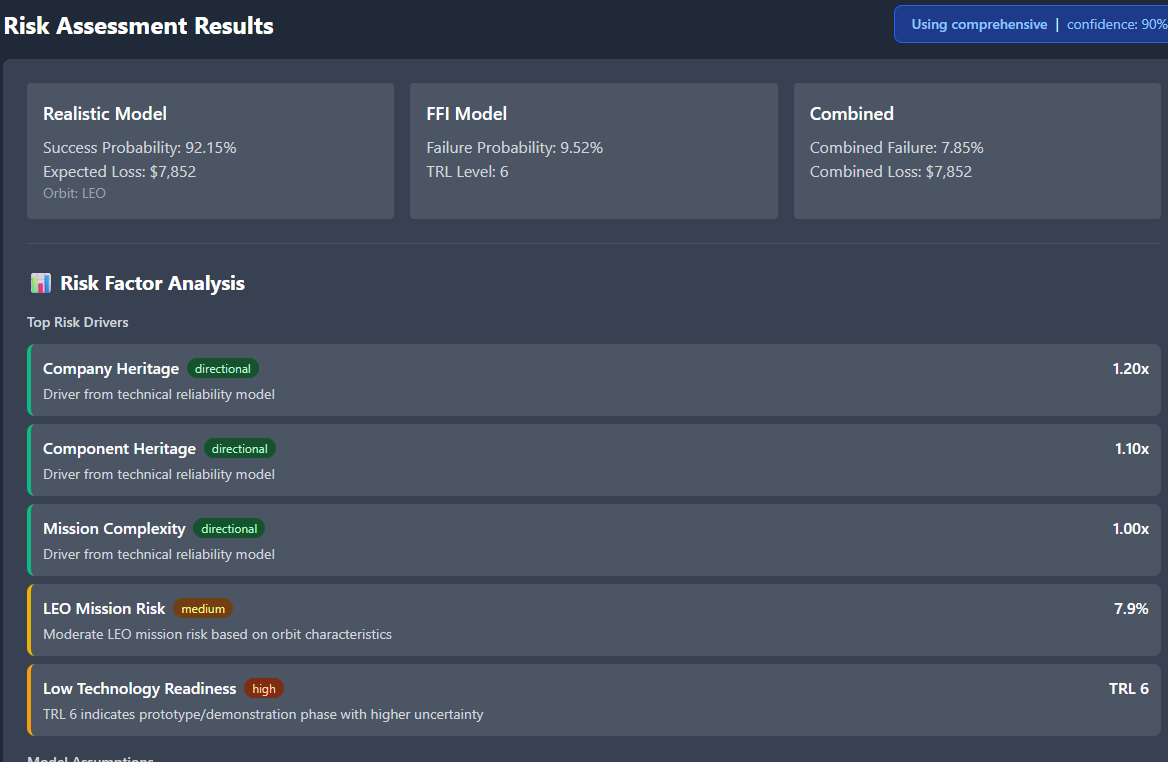

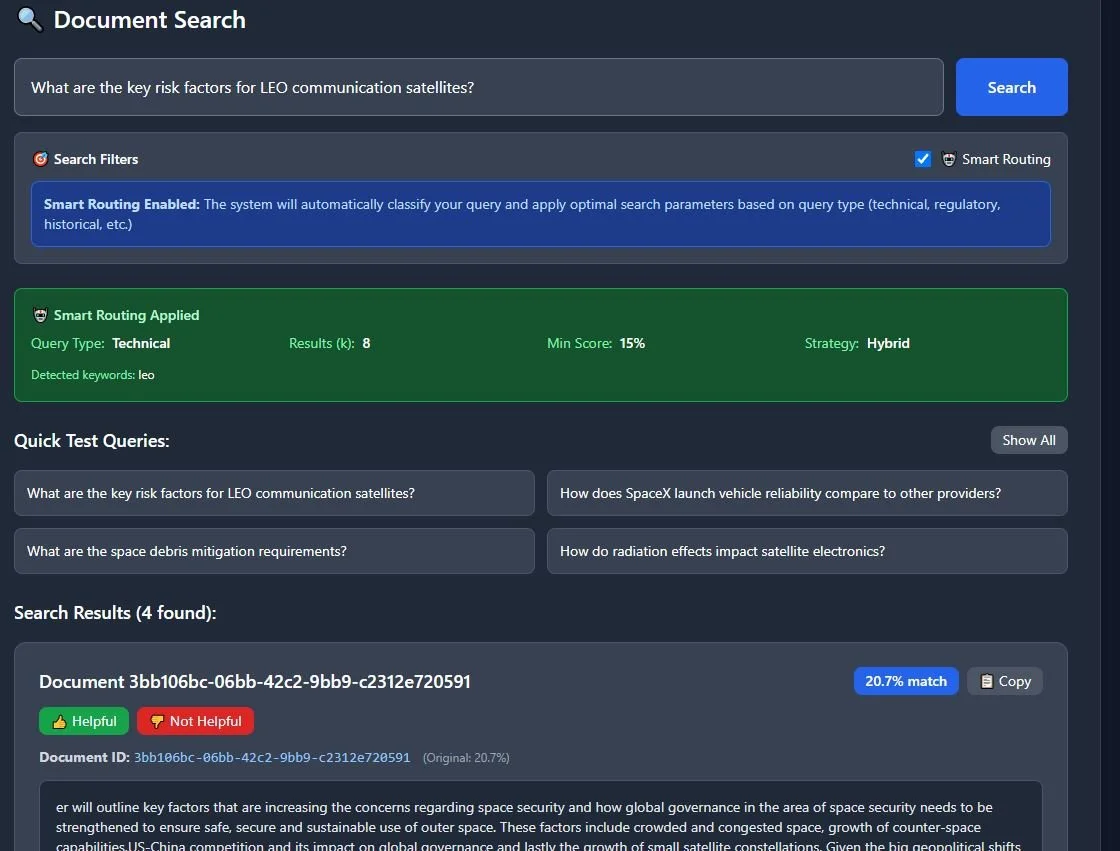

2. Hybrid Search + Glass-Box Narrative

A search engine that fuses:

vector similarity (semantic meaning)

BM25 keyword search

recency

reliability scoring

Every risk assessment comes with a narrative: bullet points, regulatory citations, and methodology references.

Not just "premium is 5.6%" but "here's why, here's the clause, here's the comparable mission".

3. Portfolio Memory (Similar Missions)

Every priced mission is saved as an embedding.

When a new submission comes in, the system finds similar missions by orbit, mass, heritage, and premium band.

"We've seen this before" → instant reference pricing and consistency.

4. Metric Explainability

Click any metric (failure_risk, premium, VaR, phase risks) and get:

the formula used

the inputs for this mission

comparable values from similar missions

links back to methodology docs

It takes AION from black box to glass box.

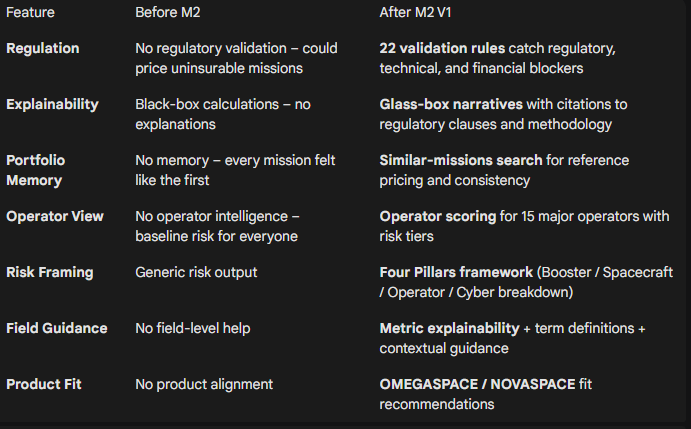

Before Module 2 vs After Module 2

Module 2 is now FROZEN for V1.

This isn't ongoing tinkering—it's a shipped, production-ready module with 30 passing tests, 80%+ coverage, and complete documentation.

Next step: build on top of it with Module 3.

How It Works: Inside the Context Engine

Building a glass box isn't just prompt engineering. It requires architecture that forces the AI to check its facts before it speaks.

3a. Regulatory Validation: The Gatekeeper

Module 2's rule engine runs before any pricing logic. It applies 22 validation rules across four categories:

Regulatory compliance: ISO 24113 (25-year disposal), FCC 5-year deorbit, UKSA licensing

Market access: ITAR/EAR restrictions (China, India, Vietnam, Thailand)

Financial viability: Flags operators with <6 months funding runway

Sanctions & export control: LMA 3100A sanctions clause, US content thresholds

Each mission gets a traffic light (GREEN/AMBER/RED). RED flags block the quote entirely. AMBER flags add premium loadings with regulatory justification.

Example: A LEO constellation with a Chinese parent company triggers the Foreign Ownership Rule → AMBER flag → cites specific ITAR clause → adds 15% premium load.

This isn't an LLM guessing. It's deterministic logic checking real regulatory requirements. It stops you from wasting capital on uninsurable risk.

3b. Hybrid Search + Glass-Box Narrative

The biggest risk in AI for insurance isn't hallucination—it's opacity.

To solve this, I built a hybrid search engine that fuses:

Vector search (pgvector HNSW) for semantic similarity

BM25 keyword search (PostgreSQL full-text) for exact clause matches

Reciprocal Rank Fusion to merge results

Weighted scoring: 40% semantic + 30% keyword + 15% recency + 15% reliability

The corpus includes UKSA regulations, ISO standards, FCC rules, ESA guidelines, and internal methodology docs (Weibull parameters, pricing logic, Monte Carlo VaR).

Every risk narrative comes with citations. Not "this mission is risky because AI said so" but "this mission triggers Clause 5.1 of ISO 24113 because the deorbit plan exceeds 25 years."

The system doesn't just find close text—it finds the most trustworthy clauses for the specific mission configuration.

3c. Portfolio Memory: "We've Seen This Before"

Human underwriters rely on memory: "This looks like that Starlink launch from 2022."

Module 2 replicates this with a memory system.

After each pricing run, AION saves:

Mission summary (as vector embedding)

Key stats (orbit, mass, heritage, premium, risk band)

Coverage structure and operator profile

When a new mission arrives, the system searches for similar missions across three dimensions:

Semantic similarity (mission description and risk profile)

Configuration proximity (orbit, altitude ±100km, mass, launch vehicle)

Pricing band (premium within ±2%)

Result: Reference pricing for consistency. "We priced three similar LEO comms missions at 4.2–4.8%; this one at 4.5% is in line with portfolio precedent."

This creates an instant feedback loop: "We've seen this before." It ensures pricing consistency across the portfolio and prevents underwriters from starting from zero on every deal.

3d. Metric Explainability: No More "Trust Me"

In Module 1, metrics were black boxes. Module 2 makes them transparent.

Click any metric (failure_risk, premium, VaR, launch_phase_risk) and get:

The formula (e.g., Weibull β parameters, phase risk weightings)

The inputs used for this specific mission

Comparable values from similar missions

Links to methodology documentation

Example: Premium of 5.6% → Formula breakdown → Shows launch heritage factor (0.92), TRL adjustment (1.15), cyber gap loading (+0.8%) → Links to Weibull_Methodology.md and Heritage_Scoring.md

This turns the dashboard from a static display into a teaching tool for junior underwriters. They can see why the number is what it is, backed by methodology docs, not just LLM output.

Why It Matters

For Underwriters

Module 2 delivers defensible decisions under scrutiny.

When a broker pushes back on a quote, or a regulator asks why you declined coverage, you aren't guessing. You have:

Regulatory citations for every validation flag

Portfolio precedent from similar missions

Methodology docs backing every metric

A regulator-ready narrative with sources

It's the difference between "the model says no" and:

"This mission violates ISO 24113 Clause 5.1; here are three comparable missions we declined for the same reason, and here's the regulatory framework we're operating under."

For AION as a Product

Module 1 proved I could build risk models.

Module 2 proves I understand how underwriters actually think: regulatory frameworks, portfolio consistency, explainability under pressure.

This isn't a tech demo built in isolation. It's a tool designed with underwriting logic baked in from the start:

22 validation rules catching what experienced underwriters would flag manually

Four Pillars framework mirroring how Lloyd's syndicates structure risk

Similar-missions search replicating institutional memory

Glass-box narratives that can be sent directly to brokers

For an employer like Relm, this shows systems thinking at the domain level, not just coding ability.

For My Portfolio

Together, M1 + M2 demonstrate:

M1: I can build Monte Carlo risk engines, phase-based models, and pricing logic

M2: I can layer regulatory intelligence, RAG pipelines, and explainability on top

Combined: I can ship production-ready systems fast (9 days for M2) with real business value

This is what the space insurance industry needs: someone who can move between quant modelling, regulatory compliance, and product design without translation layers.

What's Next

Module 2 is frozen. The Context Engine is production-ready.

But AION isn't done. The full vision needs three more pieces.

Immediate: Broker Wizard Flow (In Progress)

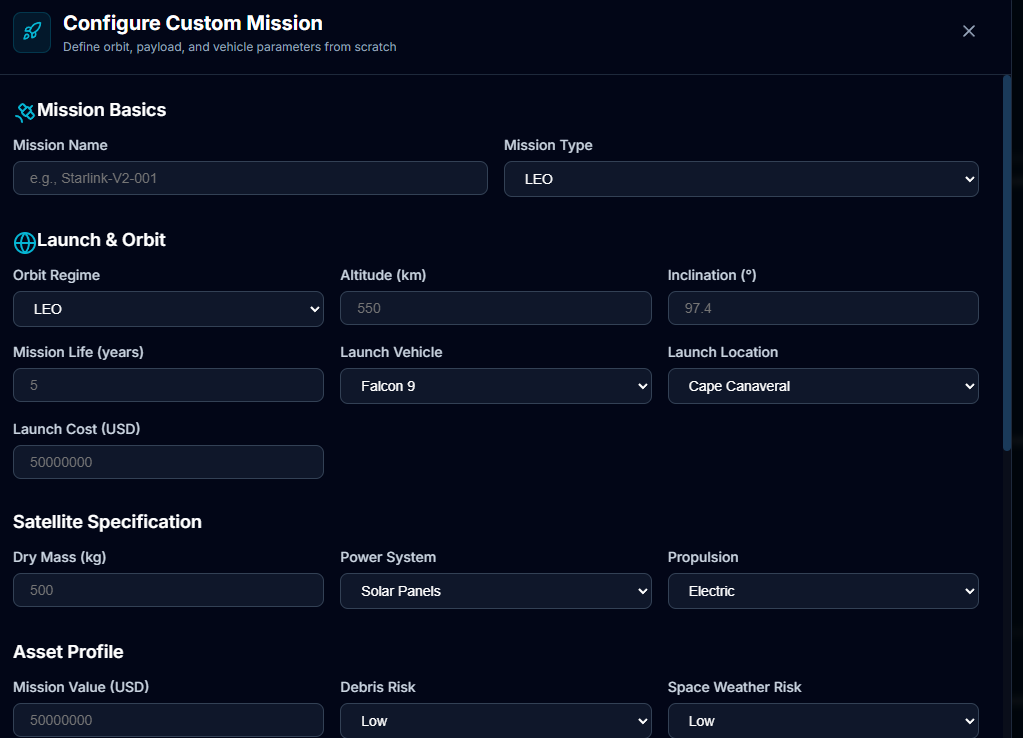

Right now, the underwriter flow (M1 + M2) works end-to-end. Brokers need a different interface—simplified submission, portfolio view, and quote comparison.

I'm building the broker-facing flow now (NOVASPACE): a three-step submission wizard with cyber posture assessment, governance scoring, and product risk profiling. Cleaner inputs, batch quoting, and exportable deal sheets.

Next: Polish & Integration

Once the broker wizard is complete, I'll tighten the handoff between the two flows:

Broker submits → mission config + portfolio context

Underwriter reviews → validation flags + similar missions + M2 narrative

System recommends → GREEN / AMBER / RED with premium and terms

The goal is a fully joined-up submission-to-quote workflow across both interfaces.

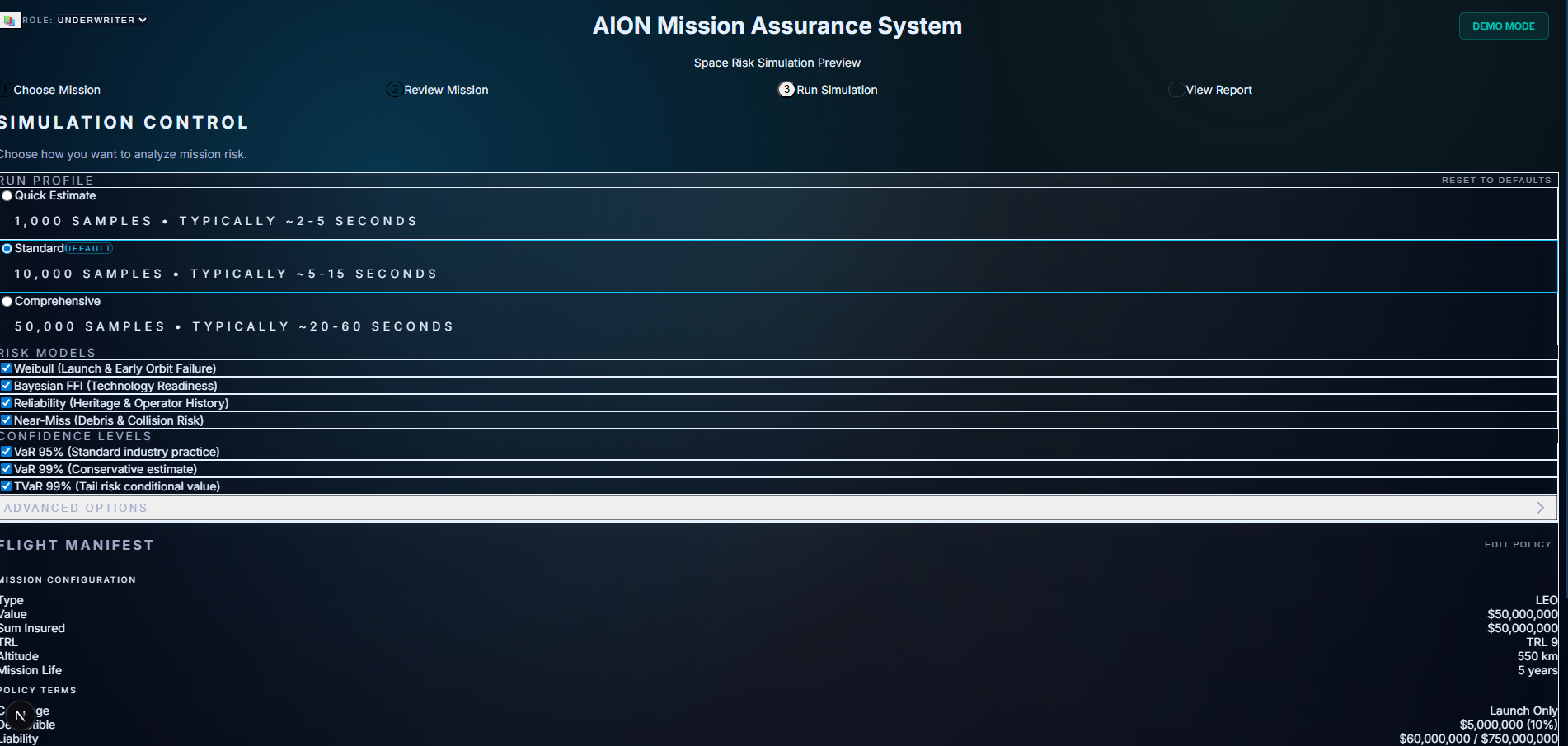

Then: Module 3 — Parametric Engine

The final piece of the core stack: how do we pay claims?

Module 3 will handle:

Parametric trigger definitions (launch failure, orbit insertion, collision events)

Event stream integration (space weather, debris conjunctions, anomaly feeds)

Trigger clause justification (using M2's regulatory and technical context)

Claims automation once trigger conditions are met

At that point, AION becomes a full lifecycle space risk platform:

submission → validation → pricing → monitoring → claims.

Technical Stack & Key Metrics

Backend

FastAPI (Python 3.11)

PostgreSQL 15 + pgvector (HNSW vector index)

SQLAlchemy 2.0 + Alembic

OpenAI

text-embedding-3-small(embeddings)Anthropic Claude Sonnet (narrative generation)

Frontend

Next.js 14 + React 18

TypeScript 5+

Tailwind CSS 3+

Zustand (state management)

Module 2 Metrics

Timeline: 9 days (2–11 December 2025)

Effort: ~180 hours across 11 phases

Code: ~12,500 LOC (≈8K backend, 4.5K frontend)

Tests: 30 tests, 80%+ coverage, 100% pass rate

Rules: 22 validation rules

Data: 6

context_*database tablesAPI: 10+ dedicated Context Engine routes

Status: ✅ Frozen for V1

AION: Module 1 Phase 3-5

By the end of Phase 2, AION's risk engine could model realistic failure curves and price missions—but it wasn't production-ready. Phases 3, 4, and 5 transformed it from prototype to platform: 7 phase-specific actuarial models, regulatory compliance tracking, Lloyd's-grade UI, and <0.3s response times. Built using AI agent orchestration across research, planning, and execution. The result: a dependable underwriting workbench that real underwriters can trust. This is the story of that transformation—the obstacles, the iterations, and the systems thinking that made it possible.

From Prototype to Production: Building an Underwriting Engine

By the end of Phase 2, AION's risk engine could model realistic failure curves, price missions, and explain its reasoning.

That was a milestone — but it still wasn't a tool an underwriter could rely on day-to-day.

The gap between "working model" and "production system" turned out to be wider than I expected. Phases 3, 4, and 5 were about closing it.

These phases weren't about training new models or adding clever features. They were about turning a model into a system: stable, secure, testable, exportable, and usable.

AION had to shift from a prototype into something with structure, memory, repeatability, and the beginnings of operational discipline.

Here's how that transformation unfolded.

Phase 3 — Systemisation: Modeling How Insurance Floors Actually Work

Phase 3 focused on building the spine of Module 1: the architecture that would let this engine operate inside a real underwriting syndicate.

This wasn't just technical refactoring—it was modeling how insurance floors actually work.

A Unified Architecture

I consolidated the entire module behind a single flow:

Mission → Risk Engine → Pricing Engine → Explainability → Exports/UI

This introduced clean separation between:

Technical risk

Business factors

Compliance constraints

Environmental modifiers

Explainability

Everything finally pointed in the same direction. The engine could now answer questions like: "Is this mission risky because of the tech, or because of the operator's track record?" Those layers were finally distinct.

RBAC: Permissions That Understand Hierarchy

I implemented Role-Based Access Control (RBAC), distinguishing between Viewers, Analysts, and Underwriters.

This wasn't just permission bits; it was about modeling the actual hierarchy of an insurance floor:

A Viewer can see assessments

An Analyst can price missions

But only an Underwriter can approve exports and sign off on quotes

Small detail, but it signals that AION understands the business, not just the math.

A Proper API Layer

The API now has:

Versioned routes (

/api/v1/...)Strict request/response schemas

Predictable validation

Stable error shapes

Once the schema was locked, downstream components stopped breaking. This was a small change with a huge effect: integration became stable.

The Orchestrator Pattern

The Risk Engine became modular, predictable, and extensible.

Each model (Weibull, Bayesian, Reliability, Environment) now plugs into a single orchestrator that handles:

Model execution

Graceful fallback

Agreement scoring

Normalisation

Unified output

This eliminated entire categories of bugs and made calibration easier.

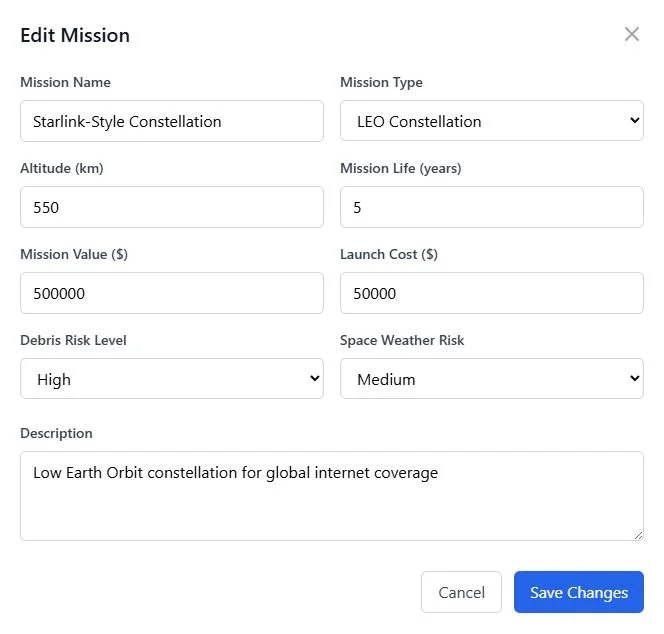

Support for Multiple Mission Types

Phase 3 introduced structured support for LEO, MEO, and GEO—each with its own logic and failure behaviour.

This removed one of the biggest silent flaws from early versions: treating all missions as interchangeable.

Phase 4 — Iteration: Building the Underwriting Workbench

Phase 4 was the most demanding phase of Module 1 so far.

It wasn't about algorithms—it was about iteration. Dozens of small sprints. Daily refinements. Continuous rewrites of the UI and logic surfaces until things felt consistent.

It was the closest experience yet to real product building.

The UI Overhaul: Making Risk Legible

Phase 4 forced me to take the UI seriously.

I'd been treating it as a wrapper around the models, but every time I tested the flow, I'd lose track of where in the mission lifecycle the risk was coming from. The interface wasn't just unclear—it was hiding the logic.

So I built the 7-Phase Mission Timeline—not just a list of dates, but a visual decision path that traces risk from Manufacture through Decommissioning. You can see historical incidents (like Intelsat 33e) mapped directly onto the timeline, showing exactly when and why certain missions failed.

What started as a functional layout became a fully restructured Underwriting Workbench:

A calmer, darker mission-view aesthetic

Clear left-to-right hierarchy

Risk band + confidence indicators

Pricing decomposition

Compliance status

Mission metadata

Environmental modifiers

A unified assumptions drawer

The design language shifted too. I moved to a Lloyd's-grade palette: navy, teal, and brass—the colours of the London insurance market. This wasn't aesthetics for its own sake. If you're building a tool for underwriters, it has to look like it belongs on their desk.

Every time I rewired something in the backend, the UI had to be reconsidered. Every time the UI exposed a gap in thinking, the backend had to be adjusted.

This back-and-forth created one of the deepest learning loops of the entire project.

Underwriter Export Packs

Phase 4 introduced exportable underwriting packs:

Mission summary

Risk assessment

Pricing components

VaR/TVaR

Compliance notes

Top risk drivers

Assumptions

Each pack is signed with a SHA-256 hash, making the result tamper-evident.

This is the first time AION produced an artefact you could send to a colleague and say, "This is the underwriting file."

Scenario Engine: Revealing Trade-Offs

Underwriters think in deltas:

"Show me the difference if TRL drops"

"What if lifetime increases?"

"What if orbit shifts?"

The scenario engine made this possible. It doesn't optimise—it reveals trade-offs.

Phase 4 Was Iteration at Scale

This phase became less about "finishing features" and more about wrestling the product into clarity:

Fixing drift between API and UI

Renaming fields for clarity

Aligning the risk and price narratives

Rewriting store logic

Adding proper null-safety

Reorganising assumptions

Refining mission types

Improving performance

Tightening validation

By the end, Module 1 finally felt integrated. Not perfect—but coherent.

Phase 5 — Hardening: Discipline as Character

Phase 5 gave Module 1 something new: discipline.

This phase wasn't glamorous, but it changed the system's character.

The Actuarial Spine

Hardening wasn't just about writing tests. It was about replacing generic allocation logic with 1,238 lines of phase-specific actuarial code—seven distinct models, one for each mission phase:

Launch: Bernoulli distributions across 15 launch vehicles (Falcon 9, Ariane 6, Electron, etc.)

LEOP (Launch and Early Orbit Phase): Early-orbit failure curves based on historical data

In-Orbit: Weibull survival models calibrated to mission life

Payload Mission Deployment: Component-level reliability tracking

Collision Avoidance: Conjunction risk and debris environment

Quality Assurance: Manufacturing and testing rigor assessment

Decommissioning: Post-Mission Disposal (PMD) reliability tracking

This wasn't cosmetic. It meant that when AION says a GEO mission has a 3.4% annual loss probability, it's not guessing—it's running 100,000 Monte Carlo simulations across phase-specific hazard functions.

And it's fast:

Pricing latency: ~0.24 seconds

Assessment: ~0.07 seconds

Export packs (with full audit trails): ~0.27 seconds

A Full Test Suite

Module 1 now has tests for:

Each individual model

API contracts

Integration flows

Performance thresholds

Scenario comparisons

This caught issues that would otherwise hide in quiet corners—mismatched schemas, missing fields, orbit crossover bugs, incorrect priors, and more.

Observability

Phase 5 added:

run_idcorrelation_idStructured JSON logs

Metrics endpoints

API health checks

A system you can observe is a system you can fix.

Database Evolution Without Fragility

Module 1 now uses a hybrid storage strategy:

Relational fields for common queries

JSONB for risk output, pricing, explainability, scenarios, and assumptions

This prevents migration churn and keeps the engine adaptable.

Regulatory Intelligence, Not Just Risk Calculation

One thing that separates AION from a prototype is that it understands regulatory constraints, not just technical risk.

The engine now tracks:

UKSA liability bands (UK Space Agency regulatory thresholds)

ISO 24113 compliance (space debris mitigation standards)

Sanctions screening (flagging components from restricted jurisdictions)

When a mission lacks a deorbit plan or uses non-compliant encryption, AION doesn't just note it—it adjusts the pricing and flags the specific clause that's at risk.

This is what underwriters actually need: a tool that knows the rules before a quote goes out.

What Actually Broke (And What I Learned)

Orbit Logic Bugs

For weeks, GEO missions were being priced using LEO failure curves. The engine treated all satellites as interchangeable, which meant a geostationary comms satellite was getting the same hazard rate as a low-orbit cube sat.

I discovered this when a test GEO mission came back with a 12% annual premium—absurdly high for a stable, high-altitude orbit.

The fix required creating explicit mission classes with orbit-specific parameters.

Weibull Sampling Noise

I started with 10,000 Monte Carlo samples because "more is better," right?

Wrong.

The tail probabilities got noisier, and pricing latency spiked to 2+ seconds. Dropping to 2,000 samples cut the noise, improved speed by 80%, and cost less than 2% accuracy.

Lesson: engineering is about finding the right trade-offs, not maximising everything.

Schema Drift

Early on, I'd change a backend model output and the frontend would silently break. A field rename would cascade into missing JSON keys three layers deep.

The fix: lock API contracts with versioned schemas and enforce validation at every boundary.

Boring infrastructure work, but it's what makes iteration safe.

Missing JSON Keys

Certain nested fields triggered failures deep in the pricing logic. I added defensive defaults across the board—no more silent nulls.

Performance Bottlenecks

Unindexed columns and recomputation loops caused spikes. Profiling cleaned this up. Performance became predictable, not just "usually fast."

Each obstacle forced a deeper understanding of how underwriting logic interacts with engineering constraints.

What I Actually Built

Across Phases 3, 4, and 5:

7 phase-specific actuarial models (1,238 lines of production code)

15 launch vehicle profiles with tier classification and historical reliability data

~40 conditional risk drivers that adapt based on mission parameters

~15 actionable mitigations with quantified premium impacts

100,000-run Monte Carlo pricing engine (<0.3s response time)

Mission timeline visualisation tracing the decision path across 7 phases

Regulatory compliance engine tracking UKSA, ISO 24113, and sanctions risk

Export bundles with SHA-256 verification and PDF report generation

Full observability: correlation IDs, run tracking, model versioning

Complete UI workbench with unified AION design system

55+ bug fixes including type safety, data scoping, and performance optimisation

How I Built It

Through agent orchestration and constant research iteration.

The workflow looked like this:

Research Phase:

Deep dive in Perplexity and Gemini for actuarial standards, space insurance regulations, and technical specifications

Cross-referencing Lloyd's practices, UKSA compliance requirements, ISO 24113 standards

Planning Phase:

Compare architectural approaches across GPT, Claude, and Gemini

Iterate on sprint plans until the logic was sound across all three models

Use disagreement between models as a signal to research deeper

Specification Phase:

Build detailed spec plans in Cursor with AI assistance

Break phases into concrete sprint tasks with acceptance criteria

Define API contracts, database schemas, and UI flows before writing code

Execution Phase:

Specialised agents for different domains:

Backend agent: FastAPI routes, SQLAlchemy models, actuarial engines

Frontend agent: React components, UI state management, chart libraries

Testing agent: pytest suites, contract validation, performance benchmarks

Planning agent: Sprint retrospectives, obstacle analysis, next-phase roadmapping

Iteration Cycle:

Research → Compare Plans → Spec → Build → Test → Debug → Refactor → Ship

It wasn't linear. It wasn't tidy. But each cycle made the system more honest.

The key insight: AI agents don't replace judgment—they accelerate iteration. I still made every architectural decision, but I could test 5 approaches in the time it used to take to implement one.

Why I Built It This Way

Because the goal isn't the "best model."

The goal is a model an underwriter can trust—and trust requires more than accuracy. It requires:

Stability

The engine produces the same result for the same inputs, every time. Deterministic seeding, locked schemas, versioned APIs. No surprises.

Explainability

Every risk score traces back to specific drivers. Every premium breaks down into pure risk + catastrophe load + expense + profit. If an underwriter can't explain it to a broker, the model failed.

Calibration

LEO missions price between 5-15%. GEO missions between 1-5%. These aren't arbitrary—they're benchmarked against Lloyd's market rates and historical loss data.

Predictable outputs

Pricing stabilised at ~0.24s. Assessment at ~0.07s. No latency spikes. No edge-case failures. Performance became a feature, not a variable.

Clear assumptions

The assumptions drawer shows every prior, every weight, every modifier. You can see exactly what the engine believes about the mission.

Controlled surface area

Seven phase-specific models. Fifteen launch vehicles. Forty conditional risk drivers. The engine is complex enough to be realistic, simple enough to be maintainable.

A messy but brilliant model is useless. A clear, reliable one is valuable.

And in insurance, "valuable" means: Would you stake your professional reputation on this assessment?

That's the standard Module 1 had to meet.

What I Learned

1. Architecture is behaviour

Fixing structure fixes logic. The orchestrator pattern didn't just organise code—it made the engine extensible. When I needed to add a new compliance check or a seventh actuarial model, the architecture already had a place for it. Good systems are designed to evolve.

2. Explainability is part of the model, not a feature you bolt on

If you can't explain a calculation cleanly, something is wrong with how you've designed it. AION's risk drivers aren't generated by black-box ML—they're explicit, traceable, and grounded in actuarial logic. Transparency isn't optional in regulated industries.

3. Systems thinking beats feature building

Patterns compound. Features decay. The orchestrator pattern, mission type classes, validation layers—these structures paid dividends across every sprint. A good abstraction saves you from writing the same code fifty times. A bad one forces you to refactor constantly.

4. Product emerges through iteration, not planning

Phase 4's UI overhaul taught me that most clarity comes from using the system, not designing it up front. I rewrote the mission view three times. Each version exposed assumptions I hadn't questioned. The final design wasn't planned—it was discovered.

5. Reliability is the real milestone

Module 1 isn't finished—it's never "finished." But it's dependable. Tests pass. Performance is predictable. Outputs are reproducible. That dependability is what unlocks everything else: investor demos, underwriter pilots, Module 2 integration. Without reliability, nothing else matters.

6. AI agents accelerate iteration, but judgment still matters

Using GPT, Claude, Gemini, and Cursor in parallel let me test five architectural approaches in the time it used to take to build one. But the AI didn't make the decisions—it surfaced options. The discipline was in choosing well, not generating fast.

From Prototype to Platform

Module 1 started as a risk model. It ended as an underwriting workbench.

The transformation wasn't just about adding features—it was about building the architecture of trust. Every decision—RBAC roles, phase-specific models, compliance tracking, export verification—was designed to answer one question:

Would an underwriter trust this assessment?

By the end of Phase 5, the answer was yes.

Module 1 is now frozen at V1. It's production-ready, and capable of supporting the rest of AION's vision: a full-stack space insurance platform.

AION: Module 1 Phase 2

Phase 2 of AION’s Risk Engine was about moving from a working prototype to something an underwriter could actually trust. I rebuilt the core logic around survival curves, calibration, environmental sensitivities, and a clearer mission view to make risk reasoning easier, not flashier.

Building a Risk Engine That Underwriters Can Trust

Phase 1 of AION gave me something simple but valuable:

a loop that could take a mission, run a model, and explain its result.

Phase 2 raised the standard.

The question this time wasn’t “Can I build a risk model?” but:

“Can I build one an underwriter would trust for a first-pass view?”

That meant moving away from toy numbers and towards something closer to real insurance work: probability curves, calibrated priors, realistic failure rates, and a pricing engine that behaves like a disciplined actuarial tool, not a demo.

Opening the Model Up: Real Failure Curves

The first breakthrough in Phase 2 was replacing linear logic with proper survival analysis.

The engine now uses:

A Weibull lifetime curve

(infant mortality → stable phase → wear-out)A Bayesian update model for TRL and heritage

A reliability model tuned by orbit and launch vehicle

Hardware doesn’t fail in a straight line.

It fails according to curves, and capturing that shape immediately made the engine feel more aligned with historical space behaviour.

A positive example: fixing the inverted TRL priors.

In Phase 1, immature tech was being treated as safer — a comforting mistake.

Correcting it made the system more honest and more useful.

A Pricing Engine That Shows Its Working

Phase 2 introduced a Monte Carlo pricing engine with:

Premium bands

VaR95 / VaR99

Tail loss behaviour

Decomposition across pure, risk, catastrophe, expense, profit

Calibration against simple industry bands

(LEO: 5–15% of SI, GEO: 1–5%)

The engine now runs 50,000 quantile samples (seeded for reproducibility) and treats price as a consequence of the probability curve, not a lookup table.

The most important addition was the explicit premium decomposition:

Here is what drove the risk.

Here is the impact of each adjustment.

Here is why the premium sits here.

It forced me to think like an underwriter rather than a developer.

Calibrated Priors: Bringing Discipline to the Numbers

Phase 2 introduced a more disciplined calibration layer:

Blend weighting: 0.09·model + 0.91·prior

Orbit caps: LEO 0.12, GEO 0.06

Realistic failure rates: Falcon 9 ≈ 97.7% success

Severity modelling:

20% total loss

80% partial loss (Beta distribution, 10–40% SI)

These numbers aren’t perfect, but they stop the model from being overconfident just because the Monte Carlo chart looks pretty.

Calibration isn’t a cosmetic step — it’s a form of intellectual honesty.

Adding Environmental Sensitivities

Space isn’t a static environment, so the model shouldn’t be either.

Phase 2 added:

Conjunction density → increases probability

Solar activity (solar_high) → increases severity and thickens the tail

These modifiers aren’t meant to be hyper-accurate.

They’re meant to teach the right behaviour:

Risk is dynamic.

Compliance: The First Signs of Real-World Constraints

I added a light compliance layer that addresses the following areas:

licensing

deorbit planning

anomaly reporting

grey-zone mapping (

fallbacks.yaml)

If a mission is unlicensed, the model applies a simple, transparent rule:

+10% premium, via a feature flag.

It’s the first time AION began to link technical risk with regulatory exposure — something Phase 1 ignored entirely.

A Mission View That Reduces Cognitive Load

Phase 2 reorganised the UI into a single mission workbench:

Mission profile

Risk band + confidence

Pricing band + decomposition

Compliance flags

Environmental modifiers

An assumptions drawer showing the engine’s reasoning

Adjustment chips explaining signal impacts

It’s not polished.

But it has a calm structure you can actually think inside — which is more important at this stage than visual flair.

Reducing cognitive load was the whole point.

What This Phase Taught Me

Modelling is a negotiation with reality.

Every fix — inverted priors, overflow issues, curve tuning — revealed where intuition diverged from the world.

Underwriters don’t want a number; they want the reasoning trace.

The more transparent the model became, the more confident I became in its behaviour.

Calibration is honesty encoded as math.

Small parameters grounded the system more than any big feature.

Tools shape thinking.

Designing a single mission view changed the way I built the model itself.

What Phase 2 Sets Up

Phase 2 didn’t finish the engine.

It clarified the foundation.

It taught me to build something that:

behaves predictably

explains itself rigorously

stays within calibrated bounds

is structured for future extension

can sit in front of a professional without apology

Phase 3 will focus on refining the narrative layer:

clearer assumptions, more consistent reasoning, and a tighter link between risk, environment, compliance, and price.

But for the first time, the engine feels usable.

Not finished.

Not perfect.

But grounded enough to build on with confidence.

AION: Module 1 Phase 1

Why I Started

After attending fintech and space conferences, I wanted to connect the ideas I was hearing with something practical.

AION began as a curiosity project — a way to learn how risk, data, and AI could come together in the space industry.

It isn’t a company or a product. It’s a sandbox for learning: I build, test, break, and rebuild to understand how systems like space insurance and orbital analytics might actually work.

What I Set Out to Build

The goal of Phase 1 was simple:

Take a satellite mission, score its risk, price its insurance, and explain why.

That meant creating:

✅ API contracts — stable, validated endpoints for missions, scores, and pricing.

✅ A retrieval system (RAG) — to search through documents and show where each risk factor came from.

✅ A transparent UI — where results were explainable, not black-box.

I also wanted everything to run locally through Docker in under three seconds.

If it could do that — and tell me why a mission scored 72 instead of 85 — Phase 1 would be complete.

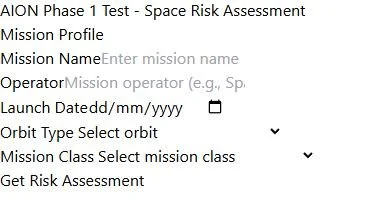

1️⃣ Mission Input Interface — Enter a satellite profile and select orbit/class.

2️⃣ Assessment Result — Risk = 72 | Confidence = 62 % | Premium ≈ $1.28 M.

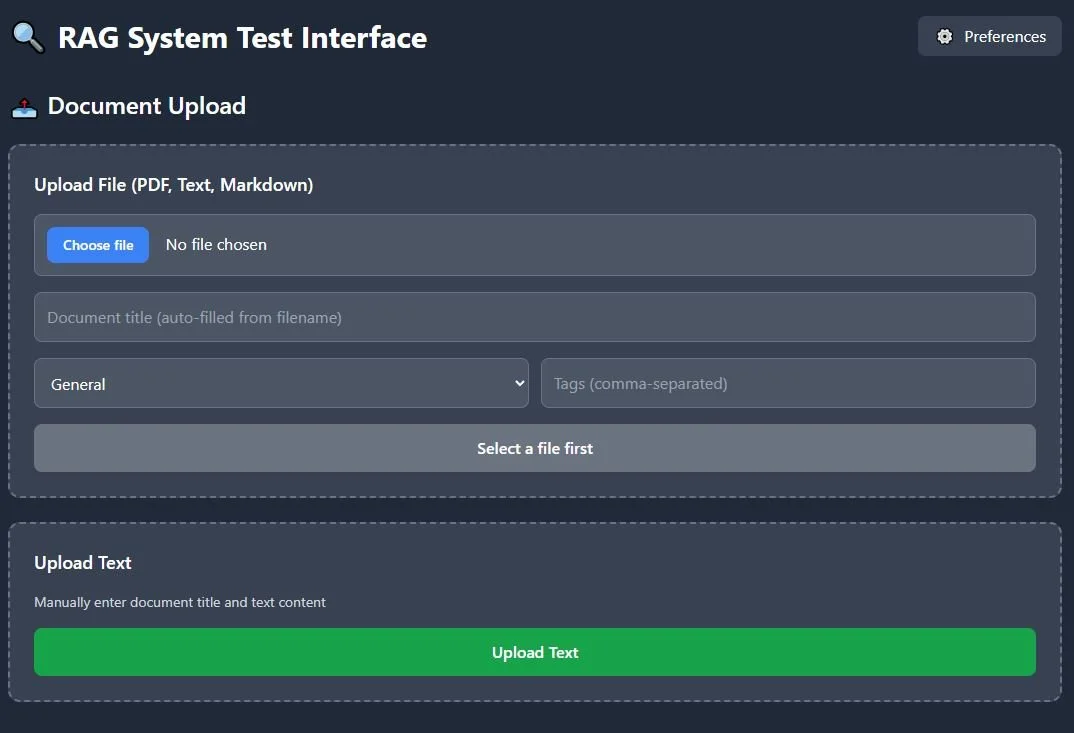

3️⃣ RAG Upload — Upload PDFs or notes; system tags and embeds them.

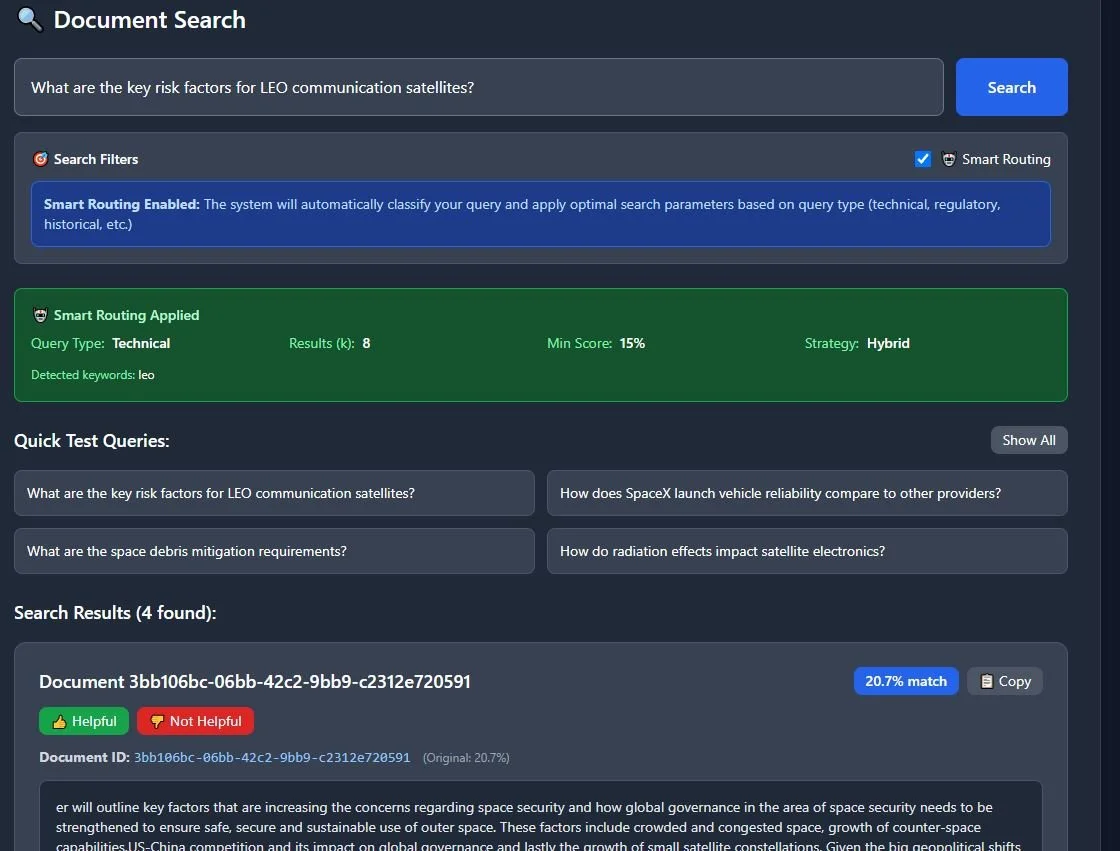

4️⃣ Smart Search — Ask: “What are key risk factors for LEO satellites?”

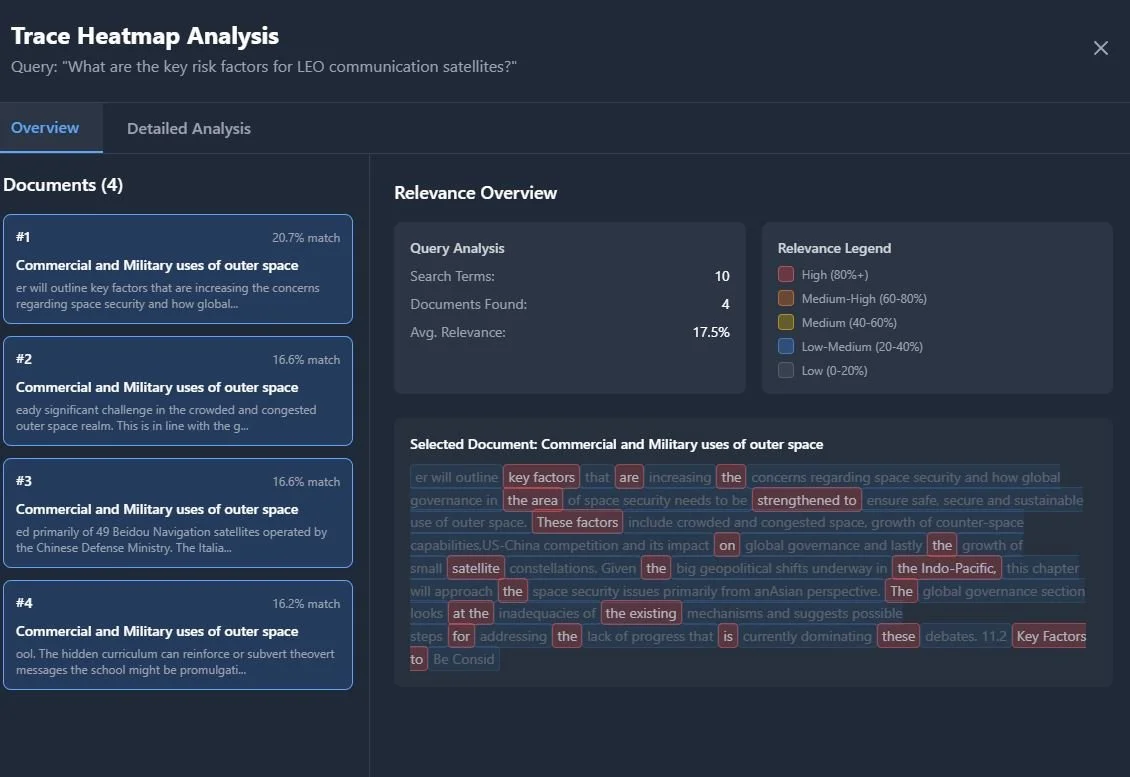

5️⃣ Heatmap View — Visual relevance highlights show why the answer appears.

What Went Well

Full working loop. The app can score and price a mission in under three seconds.

Explainability first. Every result shows its sources and reasoning.

End-to-end integration. Backend ↔ Frontend ↔ Database ↔ UI now talk fluently.

Workflow discipline. I learned to structure projects in phases, document endpoints, and validate inputs like a professional build.

Coding growth. Building this with FastAPI, Next.js, and Docker taught me more about engineering logic than any course so far.

Challenges & Fixes

Every phase exposed a new gap in my understanding — and that was the point.

CORS errors: fixed with FastAPI middleware.

Docker caching: rebuilt containers with

--buildto reflect code updates.Database migrations: corrected Alembic paths and built a fallback SQL setup.

Tailwind styling not updating: cleaned config paths.

PDF titles missing in search results: surfaced document metadata in responses.

Tools I Used

🧠 FastAPI + PostgreSQL for the backend

⚙️ Next.js + TypeScript + Tailwind CSS for the frontend

📦 Docker Compose for local orchestration

🤖 Cursor as my AI-assisted code editor

I discovered it through the developer community on X (formerly Twitter), where I come across the latest tools from developers. Cursor helps me think faster and experiment more—it’s like having a silent coding partner that keeps me learning.

My workflow is simple: I read/learn something → have an idea → try building it → learn through debugging.

Each step teaches me something about space tech, AI, and my own problem-solving style.

Cursor integrated chat and editor.

What I Learned

Phase 1 taught me that:

Building forces clarity.

A clear UI is as important as accurate data.

Every technical barrier (CORS, caching, schema errors) is an opportunity to learn a concept properly.

Above all, I learnt that explaining your logic is a feature, not an afterthought.

What’s Next (Phase 2)

Phase 2 will focus on:

Integrating real orbital data — debris, weather, mission classes.

Experimenting with Bayesian and Monte-Carlo models for risk.

Expanding explainability dashboards with clearer visuals and exports.

Making the tool modular for future AI-driven insurance experiments.