AION: Module 1 Phase 2

Building a Risk Engine That Underwriters Can Trust

Phase 1 of AION gave me something simple but valuable:

a loop that could take a mission, run a model, and explain its result.

Phase 2 raised the standard.

The question this time wasn’t “Can I build a risk model?” but:

“Can I build one an underwriter would trust for a first-pass view?”

That meant moving away from toy numbers and towards something closer to real insurance work: probability curves, calibrated priors, realistic failure rates, and a pricing engine that behaves like a disciplined actuarial tool, not a demo.

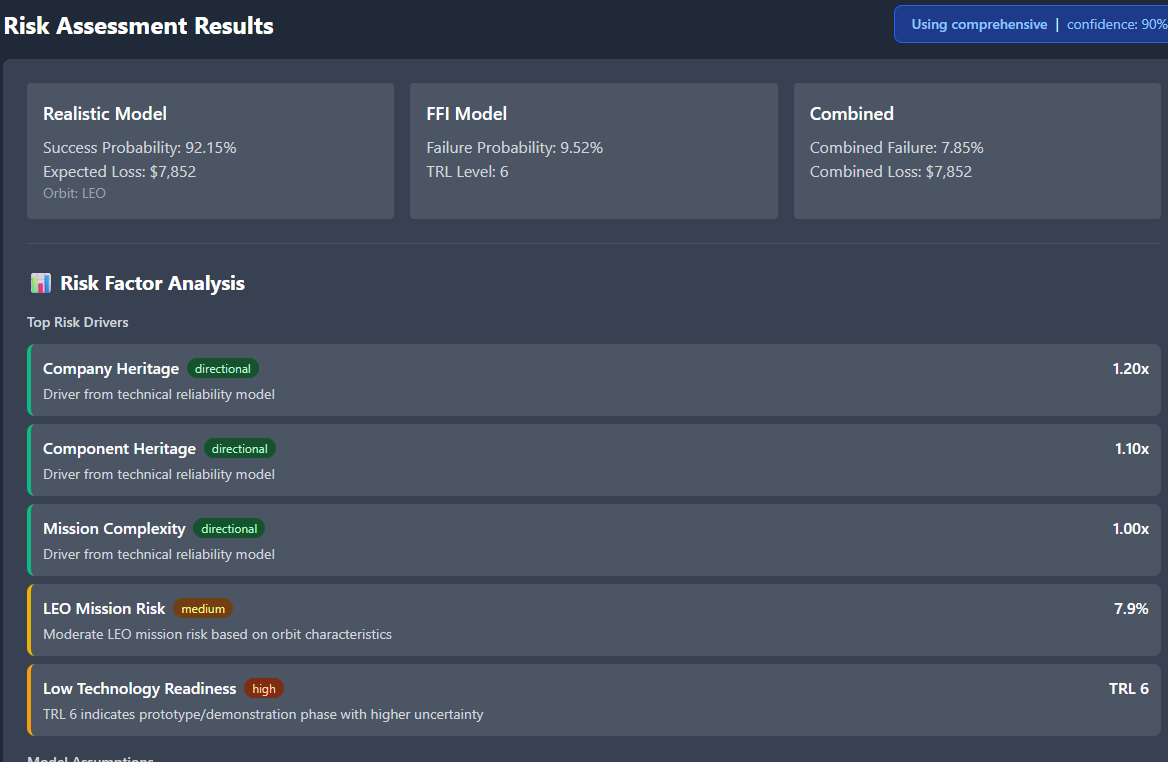

Opening the Model Up: Real Failure Curves

The first breakthrough in Phase 2 was replacing linear logic with proper survival analysis.

The engine now uses:

A Weibull lifetime curve

(infant mortality → stable phase → wear-out)A Bayesian update model for TRL and heritage

A reliability model tuned by orbit and launch vehicle

Hardware doesn’t fail in a straight line.

It fails according to curves, and capturing that shape immediately made the engine feel more aligned with historical space behaviour.

A positive example: fixing the inverted TRL priors.

In Phase 1, immature tech was being treated as safer — a comforting mistake.

Correcting it made the system more honest and more useful.

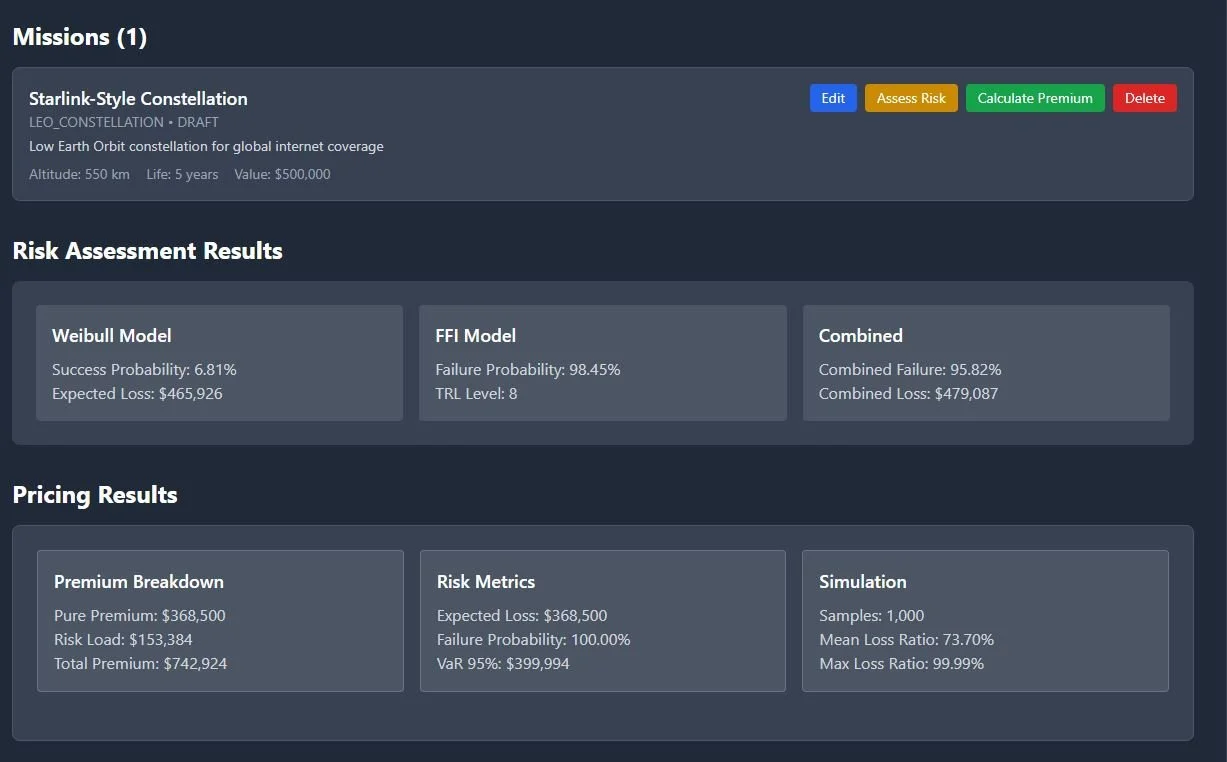

A Pricing Engine That Shows Its Working

Phase 2 introduced a Monte Carlo pricing engine with:

Premium bands

VaR95 / VaR99

Tail loss behaviour

Decomposition across pure, risk, catastrophe, expense, profit

Calibration against simple industry bands

(LEO: 5–15% of SI, GEO: 1–5%)

The engine now runs 50,000 quantile samples (seeded for reproducibility) and treats price as a consequence of the probability curve, not a lookup table.

The most important addition was the explicit premium decomposition:

Here is what drove the risk.

Here is the impact of each adjustment.

Here is why the premium sits here.

It forced me to think like an underwriter rather than a developer.

Calibrated Priors: Bringing Discipline to the Numbers

Phase 2 introduced a more disciplined calibration layer:

Blend weighting: 0.09·model + 0.91·prior

Orbit caps: LEO 0.12, GEO 0.06

Realistic failure rates: Falcon 9 ≈ 97.7% success

Severity modelling:

20% total loss

80% partial loss (Beta distribution, 10–40% SI)

These numbers aren’t perfect, but they stop the model from being overconfident just because the Monte Carlo chart looks pretty.

Calibration isn’t a cosmetic step — it’s a form of intellectual honesty.

Adding Environmental Sensitivities

Space isn’t a static environment, so the model shouldn’t be either.

Phase 2 added:

Conjunction density → increases probability

Solar activity (solar_high) → increases severity and thickens the tail

These modifiers aren’t meant to be hyper-accurate.

They’re meant to teach the right behaviour:

Risk is dynamic.

Compliance: The First Signs of Real-World Constraints

I added a light compliance layer that addresses the following areas:

licensing

deorbit planning

anomaly reporting

grey-zone mapping (

fallbacks.yaml)

If a mission is unlicensed, the model applies a simple, transparent rule:

+10% premium, via a feature flag.

It’s the first time AION began to link technical risk with regulatory exposure — something Phase 1 ignored entirely.

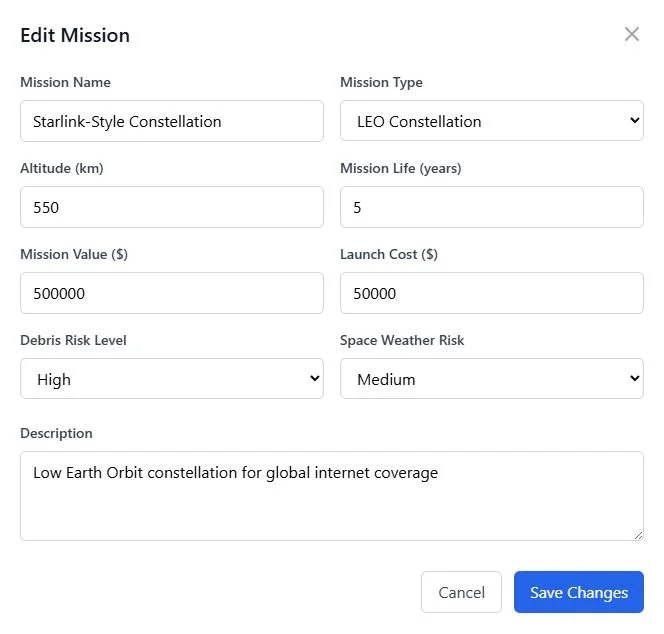

A Mission View That Reduces Cognitive Load

Phase 2 reorganised the UI into a single mission workbench:

Mission profile

Risk band + confidence

Pricing band + decomposition

Compliance flags

Environmental modifiers

An assumptions drawer showing the engine’s reasoning

Adjustment chips explaining signal impacts

It’s not polished.

But it has a calm structure you can actually think inside — which is more important at this stage than visual flair.

Reducing cognitive load was the whole point.

What This Phase Taught Me

Modelling is a negotiation with reality.

Every fix — inverted priors, overflow issues, curve tuning — revealed where intuition diverged from the world.

Underwriters don’t want a number; they want the reasoning trace.

The more transparent the model became, the more confident I became in its behaviour.

Calibration is honesty encoded as math.

Small parameters grounded the system more than any big feature.

Tools shape thinking.

Designing a single mission view changed the way I built the model itself.

What Phase 2 Sets Up

Phase 2 didn’t finish the engine.

It clarified the foundation.

It taught me to build something that:

behaves predictably

explains itself rigorously

stays within calibrated bounds

is structured for future extension

can sit in front of a professional without apology

Phase 3 will focus on refining the narrative layer:

clearer assumptions, more consistent reasoning, and a tighter link between risk, environment, compliance, and price.

But for the first time, the engine feels usable.

Not finished.

Not perfect.

But grounded enough to build on with confidence.